How Many Categories Should You Have in Your Budget?

What you'll learn

What is a Budget?

A budget is like a financial roadmap that helps you get a grip on your money. It gives you a clear view of what’s coming in and going out over a specific time. By setting spending limits and tracking your expenses, you can dodge unnecessary spending and work towards your financial goals.

To create a budget, you first break down your expenses into various categories and then allocate portions of your income to each.

The best part about a budget? It’s flexible! As your financial situation changes, your budget can easily adjust to keep up, allowing you to make changes as needed.

Key Takeaways:

- Focus on your essential expenses when organizing your budget categories.

- Keeping fewer categories makes managing your budget more straightforward.

- Simplicity not only saves time but also reduces stress.

- A flexible budget allows for easy adjustments as your financial situation changes.

- The simpler your budget, the easier it is to follow, increasing your chances of sticking to it and reaching your long-term financial goals.

How to Create Budget Categories

There’s no strict rule for how many categories your budget should have, but here’s a basic guide to help you get started.

Don’t stress about making your categories perfect, especially if you’re just starting out with budgeting. It may feel overwhelming at first, but it’s really just about figuring out where your money is going.

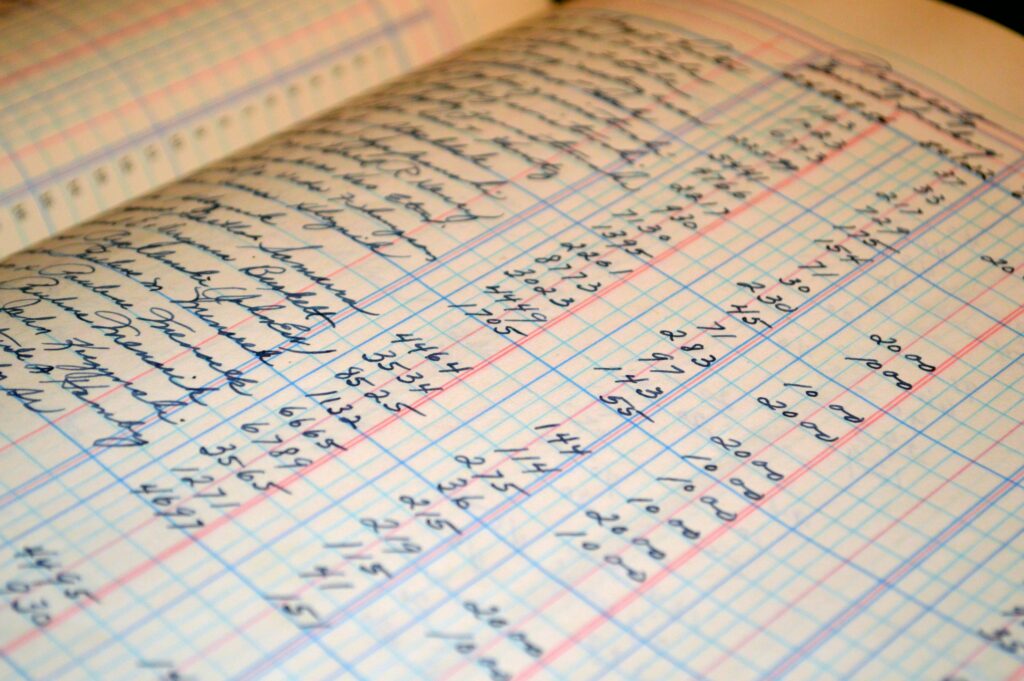

Start by identifying your essential expenses—those must-haves to live, like food, rent, and transportation. Then think about the lifestyle expenses, like subscriptions or dining out. It’s super helpful to review your bills or bank statements from the past month to see where your money is flowing.

Once you’ve identified your expenses, group them into broad categories. For example, food and drinks can go under “grocery,” while gas or public transport fares can fall under “transportation.” Keep it simple—just aim to create a general picture of your spending.

How Many Categories Should You Have?

For me, keeping it simple is essential. As a single person renting a room, I prefer to keep my budget categories minimal. Having fewer categories helps me stay motivated and makes it a lot easier to stick to my budget, especially after a long day at work. The last thing I want is to feel overwhelmed by tracking every tiny expense.

Embracing a straightforward approach helps make the budgeting process more manageable and sustainable in the long run. After all, a budget is not just a temporary tool; it’s something you’ll need to maintain for years—or even decades! That’s why keeping it easy to manage is crucial.

- Transportation: gas, bus fare, train tickets.

- Personal Care: Shampoo, skincare products.

- Groceries: staples like bread, eggs, and coffee.

- Housing: rent, utilities, internet.

- Entertainment: Netflix, books.

- Buffer/Emergency Fund: For those unexpected costs.

By sticking to these categories, I find it much easier to manage my finances. It keeps me focused on what truly matters and allows me to enjoy my life without the constant stress of overspending.

Pros and Cons of Fewer Categories

Pros

- Easier to Manage: A simple budget is easier to update and keep track of, making it more likely that you’ll stay on top of your finances.

- Saves Time: With fewer categories, you spend less time managing your budget and more time doing what you enjoy.

- Sense of Achievement: Sticking to a budget with fewer categories is more manageable, leading to a greater sense of accomplishment, which can really boost your confidence and motivation.

As your life changes—whether it’s a promotion at work, starting a side hustle, or any other significant shift—a streamlined budget makes it easier to adapt and adjust. The more progress you make, the more motivated you’ll feel to stick with it, bringing you closer to your financial goals.

Cons

- Lost Track: Without diving into the details, it’s easy to lose track of your expenses.

- Surprise Expenses: Without thorough planning, you might end up overspending due to unexpected costs.

If you don’t detail your budget, it’s easy to lose sight of your spending, which can lead to surprise expenses that disrupt your financial plan.

With fewer categories, there’s less cushion for surprises. To tackle this, it’s really important to include an emergency fund category to cover any unexpected costs and keep your budget on track.

Final Thoughts

Keeping your budget categories simple and minimal can really enhance how you manage your finances. Not only does it save you time and effort in maintaining your budget, but it also helps prevent feelings of overwhelm and frustration.

A simple, well-organized budget is much easier to adjust when life throws you curveballs, keeping you on track to meet your financial goals. Remember, budgeting is all about progress, not perfection, so make your budget as easy to follow as possible to set yourself up for success!